40+ How much can i borrow for a va home loan

Down Payments Property Mortgage Insurance Homebuyers in the United States typically put about 10 down on their homes. The loan is secured on the borrowers property through a process.

Kentucky Usda Loans Rural Housing Loans Kentucky Mortgage Loans Home Buying Process Home Buying

Your own rate and monthly payment will vary.

. However there are guidelines that you can follow in order to figure out how much of a mortgage you can afford and qualify for which is where the Maximum Mortgage Calculator comes in. The VA funding fee charts above show the amounts from the VA Handbook for some of the major categories. Not sure how much you can borrow for your home loan.

The best home improvement loan rates currently range from about 3 percent to 36 percent. PAG-IBIG SALARY LOAN - Here is a guide on how much you can borrow under the Pag-IBIG Fund salary loan offer based on members contribution. Lenders benchmark is 41 Varies per.

How to calculate your home buying budget on a 50K salary. If your credit score is over 580 you may be allowed to have a ratio as high as 4050 with this type of loan as long as you meet other requirements. The examples above assume a 375 fixed interest rate and 3 down on a 30-year mortgage.

November 12 2020 at 956 am how much the monthly payment if i can appy salary loan. A 15-year fixed-rate mortgage FRM is a type of home loan with a repayment duration of 15 years. If you cant afford a 20 down payment on your home and apply for a conventional loan youll have to have private mortgage insurance PMI to cover the costs or just plain mortgage insurance for a government loan FHA loans or VA loans for example.

From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration. Lets you replace your current loan with a VA loan and get cash out. From the loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration.

The less you. A lender reviews your income assets and debts based on self-reported information. Number of payments over the loans lifetime Multiply the number of years in your loan term by 12 the number of months in a year to get the number of payments for your loan.

Borrowers with a credit score of 580 and above could also pay as little as 35 as a down payment lower than the typical 5 or higher with a non-FHA loan. Well discuss different types of loans that come with 15-year fixed terms as well as how shorter loans can help increase your mortgage savings. 30 years the loan amount and the initial loan-to-value ratio or LTV.

045 percent to 105 percent depending on the loan term 15 years vs. Remember that lenders will still impose a maximum amount you can borrow often 80 percent or 85 percent of your available equity so a new loan or a refinance makes the most sense if the value. VA home loans are provided by banks and mortgage companies.

As you can see on the charts the size of a loans funding fee is influenced by several variables. The cons of a loan that lasts a decade longer has about 50 more total interest expense outweigh the pros of a slightly lower monthly payment or qualifying for a slightly larger loan amount. 15 vs 30 yr.

Type in your. Can I borrow even with low net take home pay. How 15-Year Fixed-Rate Loans Work.

How much house can I afford with a VA loan. Back-end DTI is the main basis. Mortgage pre-qualification is an informal estimate of how much money you can borrow for a home loan.

As the VA guarantees a portion of the loan lenders can provide better terms including 100 financing and lower interest rates. VA funding fees vary widely fro m 0 to 36 of the loan amount depending on the veterans military service and type of loan. For example a 30.

How the Loan Works. The following table shows loan balances on a 200000 home loan after 5 10 15 20 25 30 35 40 years for loans on the same home. What is the VA Home Loan Guaranty.

Principal interest taxes and. Total monthly mortgage payments are typically made up of four components. Such as VA loan.

The USDA program is for rural homes while the VA program is for active duty military and military. So realistically most first-time home buyers need at least 3 down for a conventional loan or 35 for an FHA loan. And that leaves the last 10 which represents the buyers down payment amount 10 of the purchase.

Even a quarter of a percent difference in your interest rate on a 300000 loan can add 40 to 50 a month onto your mortgage payment and cost you more than 15000 in interest over the life of your loan. The actual rate you receive depends on multiple factors including your credit score annual income and. That means for a first-time home buyer down payment youd need to save.

There are two main factors that are taken into consideration to determine how much of a mortgage payment you can handle. Enter how much you want to borrow under Loan amount. Our guide can help asses your options.

Rental price 70 per night. Can help you determine the answer to how much home you can reasonably afford. But beyond that youve got to think about your lifestyle such as how much money you have leftover for travel retirement other financial goals etc.

The general rule is that you can afford a mortgage that is 2x to 25x your gross income. Some lenders allow the borrower to exceed 30 and some even allow 40. Annual mortgage insurance premium.

PMI will typically cost between 05 and 25 of your loan value annually. Should you have any questions about the VA Home Loan benefit or issues with your current home loan feel free to contact us at. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

VA loans also have the advantage of limited closing costs and no private mortgage insurance PMI. It usually takes just one to three days and can be done online or over the phone. A Homeowners Guide to Understanding Home Equity Options One benefit of home ownership is the ability to use earned equity to borrow the money you need.

This loan is typically a home equity loan HEL or home equity line of credit HELOC. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. November 5 2020 at 1240 pm Loan.

The VA home loan guaranty is an agreement that VA will reimburse a lender such as banks credit.

Who Has Student Loan Debt In America The Washington Post

Do Home Loan Rates Change On Your Existing Loan Quora

Calculate Military Pay Hawaii Affordability Calculator Eli The Va Loan Guy

Can I Be A Co Applicant In A Home Loan If I Am Already An Applicant In Another Home Loan Quora

What Is The Benefit Of The Prepayment Of A Home Loan Quora

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

Do Home Loan Rates Change On Your Existing Loan Quora

2

This Moment Makes You Who You Are Clock Turning Point Truth This Moment Makes Y Spon Point Mortgage Loan Calculator Refinancing Mortgage Refinance Loans

Do Home Loan Rates Change On Your Existing Loan Quora

Can A Home Loan Be Transferred Completely To A Co Borrower Quora

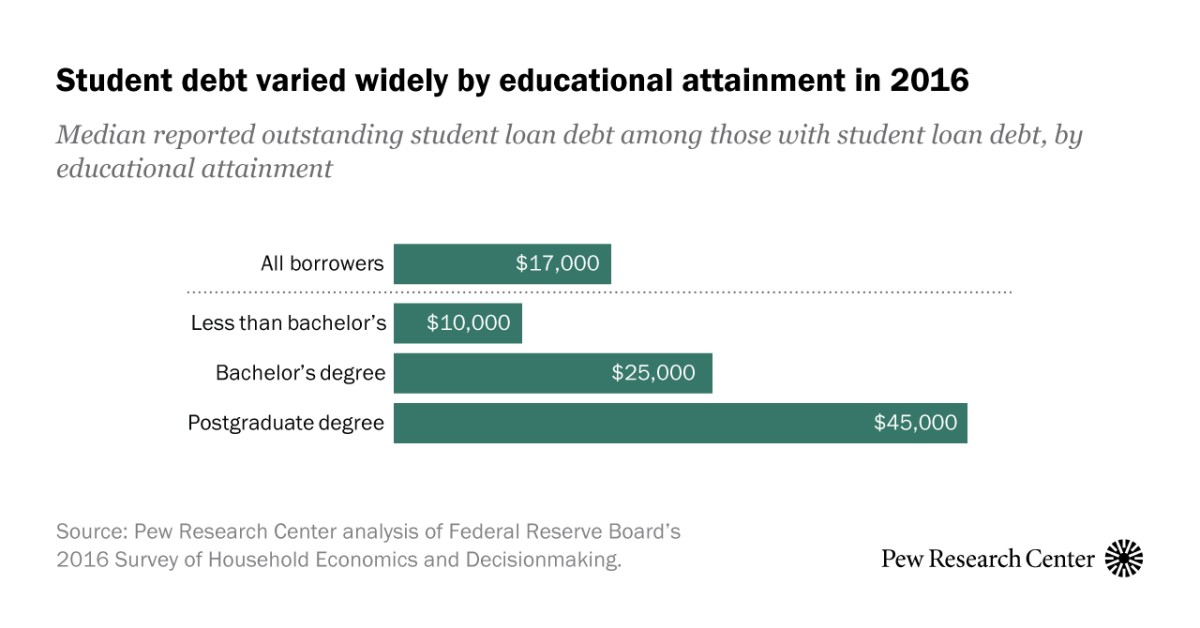

5 Facts About Student Loans Pew Research Center

Reverse Mortgage Guide The Truth About Reverse Mortgages

How Often Does An Underwriter Deny A Loan Supermoney

Are You Having An Openhouse Get A High Quality Flyer Customized To Your Property With A Rate Table Prepare Mortgage Loans Mortgage Marketing Mortgage Savings

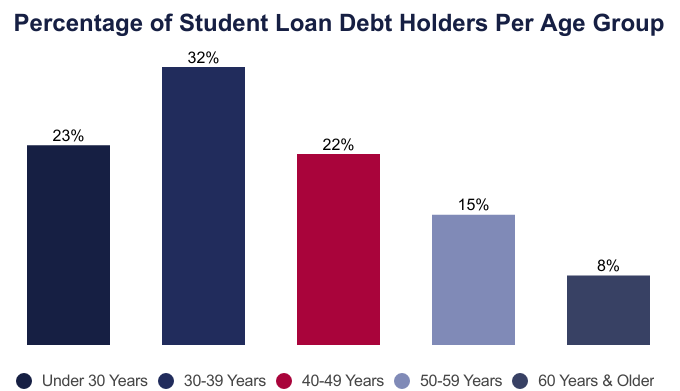

Average Student Loan Debt By Age 2022 Facts Statistics

30 Creative Financial Services Ad Examples For Your Inspiration Home Loans Banks Advertising Mortgage Loans